Tag: retirement planning

-

The 4% Rule in 2025: Does It Still Work?

Should You Still Follow the 4% Rule in 2025? The 4% rule has been the standard for decades: withdraw 4% from your retirement portfolio each year and, with proper asset allocation, your funds should last 30 years. But with higher lifespans, market volatility, and lower bond yields, is it still safe in 2025? THE 4%…

Written by

-

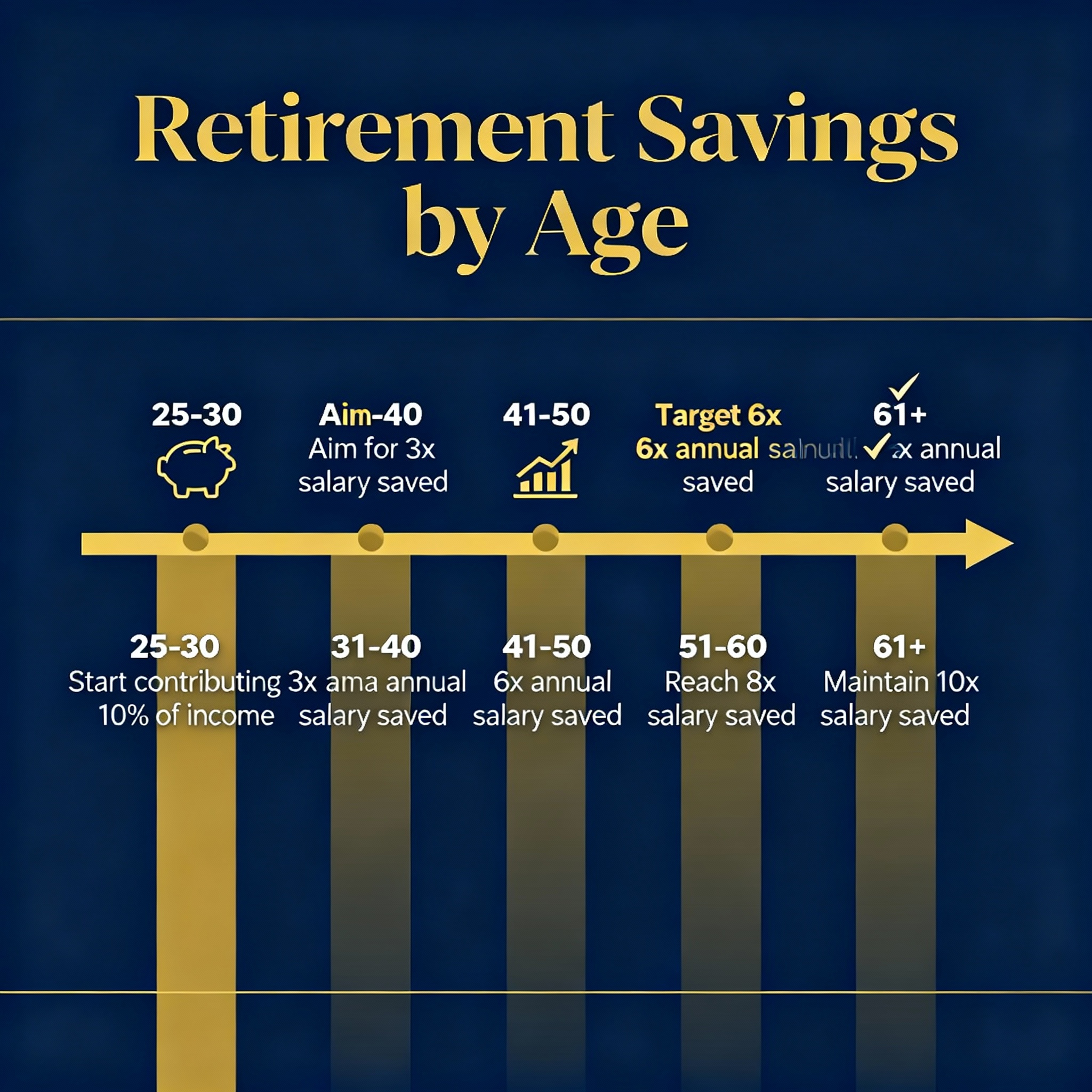

Retirement Savings by Age: Are You On Track in 2025?

The Uncomfortable Truth: Most Americans Are Nowhere Close to Retirement Ready Here’s a question that keeps many Americans up at night: “Have I saved enough?” According to Fidelity’s 2025 retirement analysis, if you’re not hitting specific savings milestones by age, the answer for most people is: no. AMERICANS AT OR ABOVE FIDELITY SAVINGS TARGETS 34%…

Written by

-

The Hidden Retirement Killer: Why 97% of Retirees Have Debt

The Shocking Truth: Debt in Retirement is Nearly Universal You worked hard your entire life. You saved, invested, and looked forward to a debt-free retirement. But here’s the harsh reality: 97.1% of retirement-age Americans carry some form of non-mortgage debt. That’s right—nearly EVERYONE is bringing debt into what should be their golden years. RETIREES WITH…

Written by

-

Retirement Readiness CRISIS: America Scores 45.8/100

America Gets a Failing Grade on Retirement Readiness If retirement readiness were a school exam, America would be failing. The National Retirement Readiness Index scored America’s retirement preparedness at just 45.8 out of 100, placing the nation in the “moderate risk” category. But let’s be honest—”moderate risk” is a polite way of saying “most Americans…

Written by