Category: Retirement Savings

-

How to Build a Resilient Retirement Portfolio: Strategies for Uncertain Markets in 2025

Building a Retirement Portfolio That Survives Market Chaos Market uncertainty is the new normal. Interest rates fluctuate. Inflation stays elevated. Stock valuations swing wildly. For retirees living off their investments, this volatility isn’t just stressful—it’s dangerous. A poorly constructed portfolio can collapse during a market downturn, forcing retirees to sell assets at the worst possible…

Written by

-

Roth IRA vs. Traditional IRA: The $50,000 Difference in Retirement

Roth IRA vs. Traditional IRA: Which Will Save You More? Choosing between a Roth IRA and a Traditional IRA can make a huge difference in your retirement income and tax bills—often tens of thousands of dollars. Understanding the differences in contributions, taxes, and withdrawal rules is key. 2025 IRA CONTRIBUTION LIMITS $6,500 + $1,000 catch-up…

Written by

-

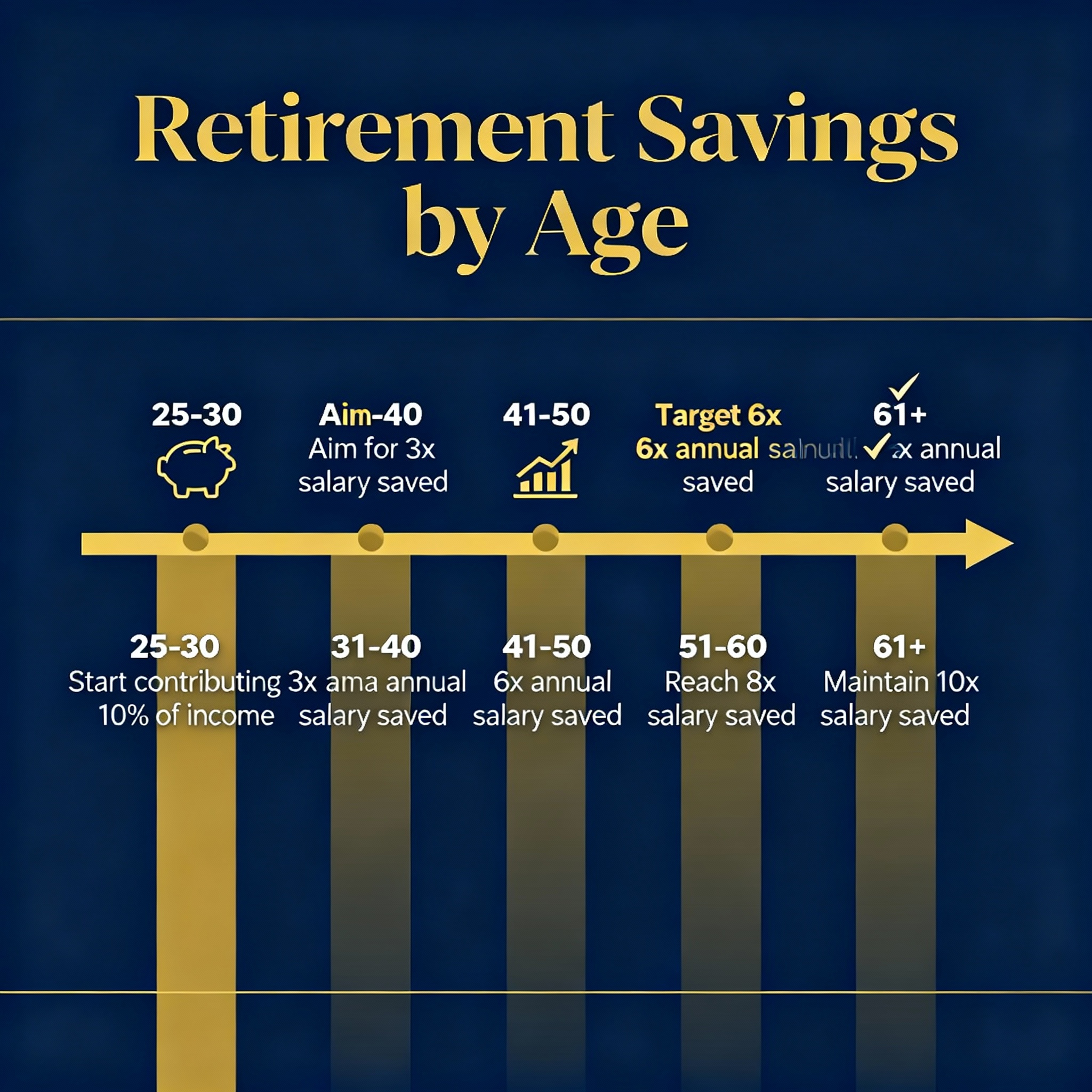

Retirement Savings by Age: Are You On Track in 2025?

The Uncomfortable Truth: Most Americans Are Nowhere Close to Retirement Ready Here’s a question that keeps many Americans up at night: “Have I saved enough?” According to Fidelity’s 2025 retirement analysis, if you’re not hitting specific savings milestones by age, the answer for most people is: no. AMERICANS AT OR ABOVE FIDELITY SAVINGS TARGETS 34%…

Written by

-

The SHOCKING Truth About American Retirement Savings in 2024

The Million-Dollar Myth: What Most Americans Actually Have Saved What if I told you that only 3.2% of American retirees have saved $1 million or more for retirement? That means 96.8% of us are falling short of what experts consider the bare minimum for a comfortable retirement. The average retirement savings for households aged 65-74…

Written by