Blog

-

Long-Term Care: The $100,000+ Cost Nobody Plans For

The Conversation Nobody Wants to Have (But Everyone Needs To) Here’s a statistic that should terrify every American: 75% of people age 65+ will need some form of long-term care before they die. But only 15% have actually planned for it. AMERICANS NEEDING LONG-TERM CARE 75% of those 65+; average duration: 3 years The Real…

Written by

-

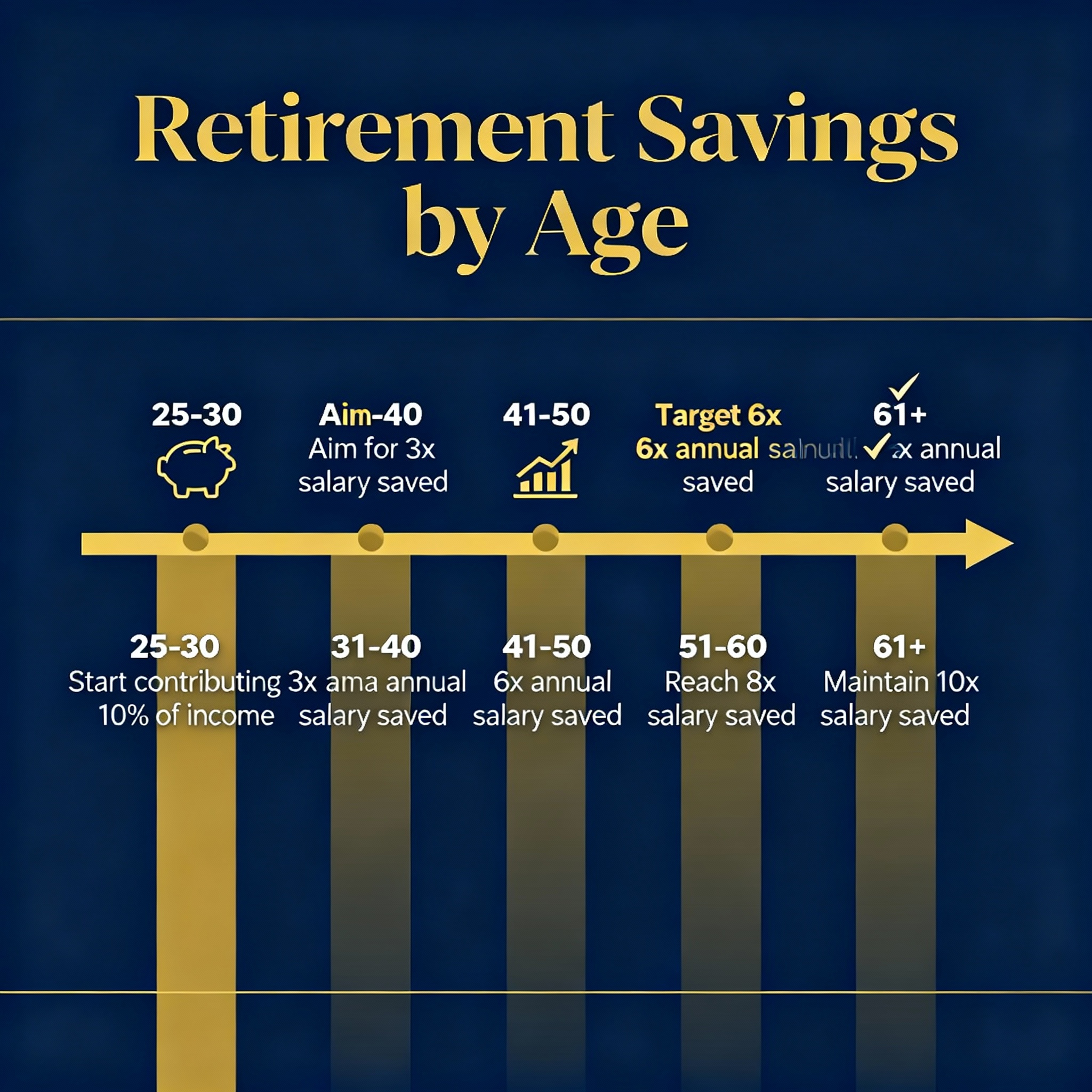

Retirement Savings by Age: Are You On Track in 2025?

The Uncomfortable Truth: Most Americans Are Nowhere Close to Retirement Ready Here’s a question that keeps many Americans up at night: “Have I saved enough?” According to Fidelity’s 2025 retirement analysis, if you’re not hitting specific savings milestones by age, the answer for most people is: no. AMERICANS AT OR ABOVE FIDELITY SAVINGS TARGETS 34%…

Written by

-

Medicare Costs in 2025: What Every Retiree Needs to Budget For

The $172,500 Healthcare Bomb Waiting for You in Retirement If you’re planning to retire in 2025, here’s a number you need to know: $172,500. That’s how much the average 65-year-old will spend on healthcare throughout retirement, according to Fidelity’s 2025 Retiree Health Care Cost Estimate. LIFETIME HEALTHCARE COSTS IN RETIREMENT $172,500 For average 65-year-old retiring…

Written by

-

401(k) Millionaires: How 537,000 Americans Beat the System

The 401(k) Millionaire Club Just Got Bigger While most Americans struggle with retirement savings, a select group has quietly achieved millionaire status through their 401(k) accounts. In 2024, there are 537,000 Americans with at least $1 million in their 401(k)s—a 27% increase from the previous year. 401(K) MILLIONAIRES IN AMERICA 537,000 +27% from 2023 Before…

Written by

-

The Hidden Retirement Killer: Why 97% of Retirees Have Debt

The Shocking Truth: Debt in Retirement is Nearly Universal You worked hard your entire life. You saved, invested, and looked forward to a debt-free retirement. But here’s the harsh reality: 97.1% of retirement-age Americans carry some form of non-mortgage debt. That’s right—nearly EVERYONE is bringing debt into what should be their golden years. RETIREES WITH…

Written by

-

Retirement Readiness CRISIS: America Scores 45.8/100

America Gets a Failing Grade on Retirement Readiness If retirement readiness were a school exam, America would be failing. The National Retirement Readiness Index scored America’s retirement preparedness at just 45.8 out of 100, placing the nation in the “moderate risk” category. But let’s be honest—”moderate risk” is a polite way of saying “most Americans…

Written by

-

The SHOCKING Truth About American Retirement Savings in 2024

The Million-Dollar Myth: What Most Americans Actually Have Saved What if I told you that only 3.2% of American retirees have saved $1 million or more for retirement? That means 96.8% of us are falling short of what experts consider the bare minimum for a comfortable retirement. The average retirement savings for households aged 65-74…

Written by