Don’t Put All Your Retirement Eggs in One Basket

The biggest mistake most Americans make in retirement isn’t about how much they save—it’s about where that money comes from.

Financial security in retirement doesn’t come from a single income source. It comes from diversification across seven distinct income streams, each with different characteristics, tax implications, and reliability levels.

RETIREES DEPENDENT ON SOCIAL SECURITY ALONE

15%

Relying on one income source

Those 15% are in the most vulnerable financial position. Retirees with multiple income sources report significantly higher satisfaction and financial security.

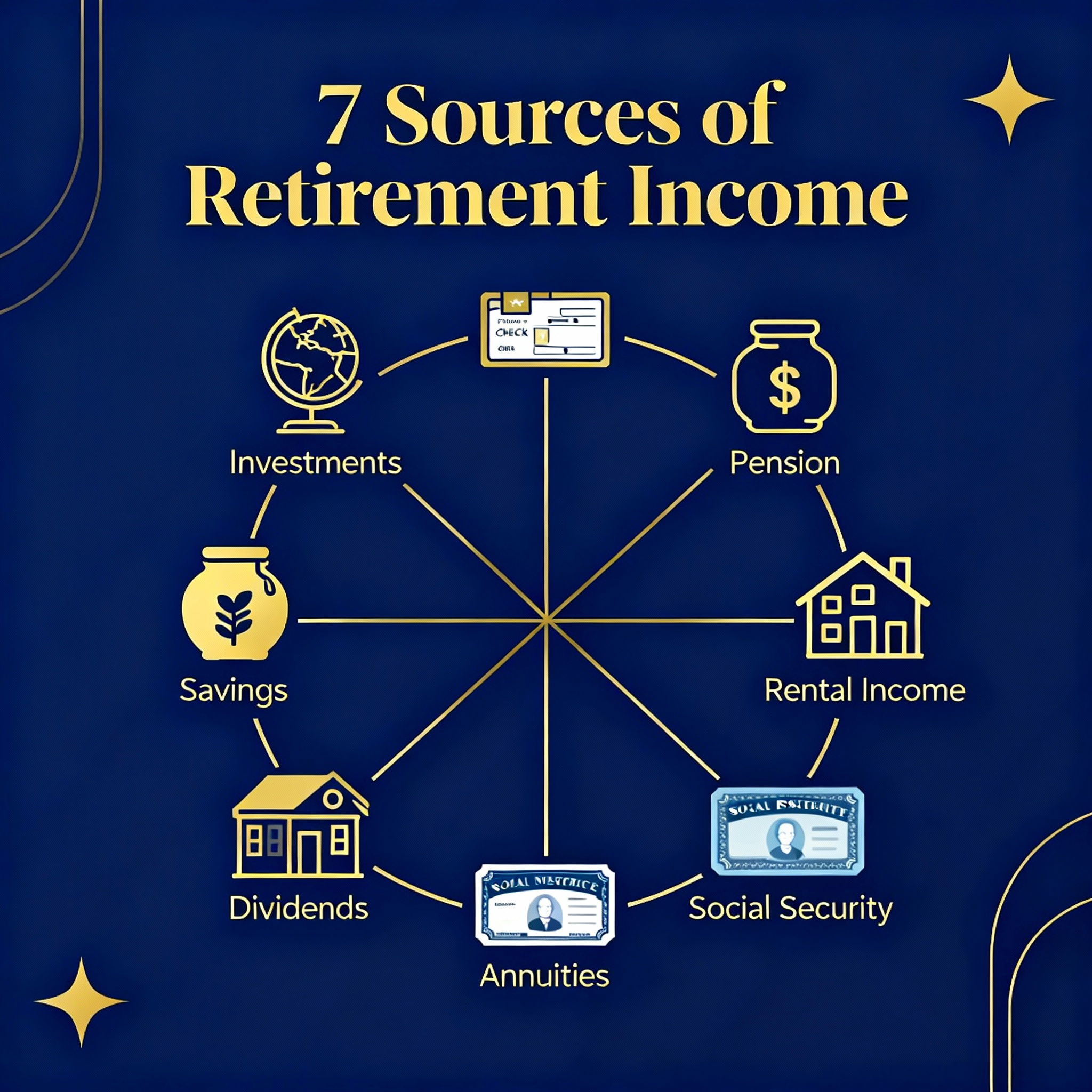

The 7 Retirement Income Sources & How They Work

Income Source #1: Social Security (31% of Average Retiree Income)

What it is: Government-provided pension based on work history

| Factor | Details |

|---|---|

| Average 2025 Benefit | $2,005/month ($24,060/year) |

| Full Retirement Age | 66-67 (depends on birth year) |

| Claiming Early (62) | 70% of full benefit (permanent) |

| Claiming Late (70) | 124% of full benefit (permanent) |

| Inflation Protection | Annual COLA adjustments |

Pros: Guaranteed income, inflation-adjusted, spousal benefits available

Cons: Insufficient alone, subject to taxation, benefit cuts potential by 2033

Income Source #2: Pensions (Defined Benefit Plans)

What it is: Employer-guaranteed monthly payment for life (increasingly rare)

Who has them: Government employees (federal, state, local), union workers, some large corporations

| Metric | Value |

|---|---|

| % of Workers with Pension | 11% |

| Avg Pension (for those who have) | $2,200-$3,500/month |

| Guaranteed for Life? | Yes |

Pros: Predictable, guaranteed lifetime income, employer-funded

Cons: Rare, limited inflation adjustment, no flexibility

Income Source #3: 401(k) & IRA Withdrawals (22% of Retirement Income)

What it is: Your accumulated retirement savings, withdrawn over time

| Account Type | 2025 Withdrawal Rules | Tax Treatment |

|---|---|---|

| Traditional 401(k) | RMDs start at 73 | Fully taxable |

| Roth 401(k) | RMDs start at 73 | Tax-free |

| Traditional IRA | RMDs start at 73 | Fully taxable |

| Roth IRA | No RMDs* | Tax-free |

*Roth IRA RMDs don’t apply to original owner, but do apply to heirs

Pros: Large accumulation potential, flexible withdrawals, tax advantages possible

Cons: Market dependent, requires discipline, forced RMDs

Income Source #4: Annuities (Guaranteed Income)

What it is: Convert lump sum to guaranteed monthly income for life

| Annuity Type | Monthly Income (per $100K) | Best For |

|---|---|---|

| Single Life | $540-$650 | Individual, no heirs |

| Life + 10 Years | $490-$580 | Balanced protection |

| Joint & 50% Survivor | $420-$500 | Married couples |

Pros: Guaranteed income, predictable, longevity insurance

Cons: Loss of flexibility, fees, no inflation adjustment (unless purchased)

Income Source #5: Taxable Investment Accounts (Dividends & Interest)

What it is: Non-retirement savings generating investment income

Average yield on taxable accounts: 2-4% annually depending on portfolio mix

Example: $250,000 at 3% yield = $7,500/year ($625/month)

Pros: Flexible, highly liquid, favorable tax treatment on long-term gains

Cons: Market dependent, requires discipline not to spend principal, taxable annually

Income Source #6: Part-Time Work & Earned Income

What it is: Continued work into early retirement (consulting, part-time, gig work)

| Work Type | Typical Monthly Income | Hours Required |

|---|---|---|

| Freelance Consulting | $1,500-$3,000+ | 10-20/week |

| Part-Time Retail/Service | $800-$1,200 | 15-20/week |

| Gig Work (Uber, DoorDash) | $500-$1,500 | Flexible |

| Teaching/Training | $1,200-$2,500 | 10-15/week |

Impact: Working even 10 hours/week can add $500-$1,000/month, reducing pension strain by 20-30%

Pros: Flexible, maintains mental engagement, boosts both income and savings

Cons: Requires health/energy, impacts Social Security if under full retirement age

Income Source #7: Real Estate & Rental Income (9% of Retiree Income)

What it is: Rental income from property ownership or house hacking

| Strategy | Monthly Income | Capital Required |

|---|---|---|

| Rental Property (paid off) | $800-$1,500 | $200,000+ |

| House Hacking/Room Rental | $400-$800 | $0 (current home) |

| Reverse Mortgage HECM | $300-$500 | $200,000+ home equity |

Pros: Passive income, inflation hedge, tangible asset

Cons: Maintenance headaches, tenant issues, tax complexity

The Income Diversification Strategy

| Retirement Lifestyle | Income Mix (% breakdown) | Risk Level |

|---|---|---|

| Conservative (Limited Income) | 60% Social Security, 30% Pensions, 10% Withdrawals | Lowest |

| Balanced | 35% Social Security, 25% Withdrawals, 20% Part-time work, 15% Investments, 5% Other | Moderate |

| Aggressive (High Income) | 30% Withdrawals, 25% Investments, 20% Part-time work, 15% Social Security, 10% Rental/Other | Higher |

Your Action Plan: Build Multiple Income Streams

Steps to Diversify Your Retirement Income

- Calculate your guaranteed income base: Social Security + Pension = your floor

- Determine your gap: Desired income – guaranteed income = amount needed from other sources

- Prioritize income sources: Build in order of tax efficiency and sustainability

- Test your plan: Scenario test with market downturns and health changes

- Adjust annually: Rebalance as your situation changes

The Bottom Line

Retirees with income diversification sleep better at night. They’re not panicking about market downturns because only 20-30% of income is at risk. They’re not scrambling because their income covers their needs.

Remember: The most secure retirement isn’t built on one income stream—it’s built on seven.

Which income sources are part of YOUR retirement plan? Share your diversification strategy in the comments below.

About the Author: Robert Chen is a Retirement Finance Analyst at RetireMetric.com, specializing in income diversification strategies and multi-source retirement planning.

Leave a Reply