The Uncomfortable Truth: Most Americans Are Nowhere Close to Retirement Ready

Here’s a question that keeps many Americans up at night: “Have I saved enough?”

According to Fidelity’s 2025 retirement analysis, if you’re not hitting specific savings milestones by age, the answer for most people is: no.

AMERICANS AT OR ABOVE FIDELITY SAVINGS TARGETS

34%

Only 1 in 3 meet their age-based targets

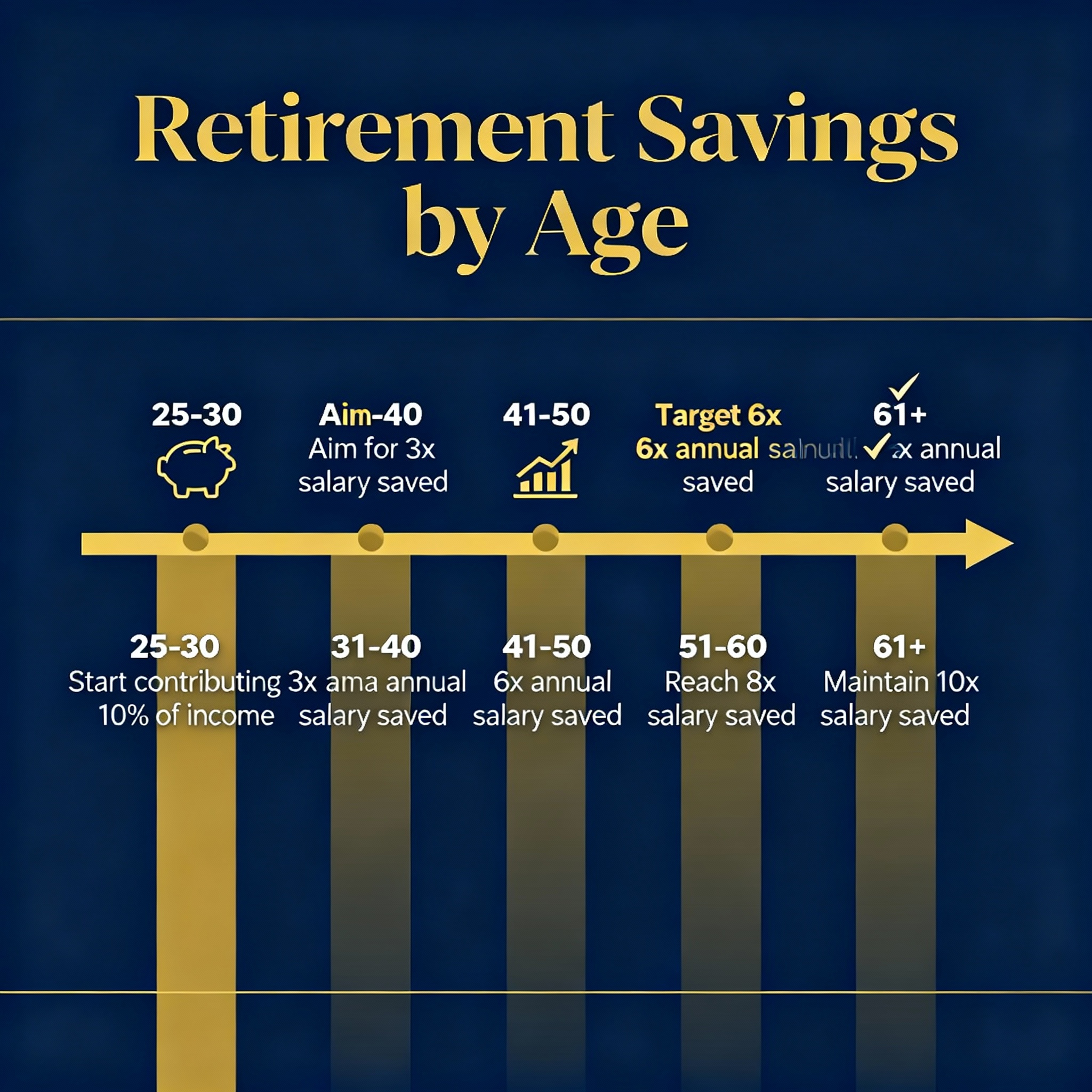

Fidelity’s Retirement Savings Benchmarks: The Gold Standard

Fidelity recommends having saved multiples of your annual salary by specific ages. Here’s what you SHOULD have:

| Age | Salary Multiplier | Example ($60K Salary) | Rationale |

|---|---|---|---|

| 30 | 1x salary | $60,000 | First milestone |

| 35 | 2x salary | $120,000 | Doubling begins |

| 40 | 3x salary | $180,000 | Acceleration period |

| 45 | 4x salary | $240,000 | Midpoint milestone |

| 50 | 6x salary | $360,000 | Catch-up increases |

| 55 | 7x salary | $420,000 | Final decade push |

| 60 | 8x salary | $480,000 | Pre-retirement max |

| 67 | 10x salary | $600,000 | Retirement ready |

Source: Fidelity Investments 2025 Retirement Savings Guidelines

The Reality Gap: What Americans Actually Have Saved

Now let’s compare what Fidelity recommends to what real Americans have actually saved:

| Age Range | Recommended | Actual Median | Shortfall | % Behind |

|---|---|---|---|---|

| Age 30 | $60,000 | $15,000 | -$45,000 | -75% |

| Age 40 | $180,000 | $35,000 | -$145,000 | -81% |

| Age 50 | $360,000 | $74,000 | -$286,000 | -79% |

| Age 60 | $480,000 | $172,000 | -$308,000 | -64% |

| Age 67 | $600,000 | $200,000 | -$400,000 | -67% |

Source: Survey of Consumer Finances 2024, Fidelity Investments

🚨 THE ALARMING TRUTH: Even people at retirement age have saved only about 1/3 of what experts recommend. This isn’t a few percent shortfall—it’s a 67% deficit.

If You’re Behind: The Catch-Up Strategy

If you’re reading this and realizing you’re behind, don’t panic. There’s a catch-up strategy that can work:

| Your Age | Current Savings Target | Monthly Needed (to reach 10x by 67) | Action Required |

|---|---|---|---|

| 40 ($100K current) | 3x ($180K) | $2,100 | Aggressive saving |

| 50 ($150K current) | 6x ($360K) | $3,850 | Maximum push |

| 55 ($200K current) | 7x ($420K) | $2,600 | Catch-up contributions |

| 60 ($250K current) | 8x ($480K) | $3,200 | Work 2-3 years longer |

How to Get Back on Track

- Calculate your current ratio: Divide savings by annual salary

- Find your age cohort: See where you are vs. target

- Determine the gap: How much do you need to save monthly?

- Maximize catch-up contributions: If 50+, add $7,500 to 401k + $1,000 to IRA

- Consider working longer: Each extra year adds ~20% to retirement savings

- Adjust expectations: Plan for a more modest retirement lifestyle

The Bottom Line

If you’re behind on retirement savings by Fidelity standards—and statistically, you likely are—the time to act is NOW. Every year you wait makes the catch-up harder.

Remember: You can’t get time back. But you can still get your finances back on track through aggressive saving, working longer, or both.

Are you on track with your retirement savings? Use Fidelity’s benchmarks to calculate where you stand and share your findings in the comments.

About the Author: Robert Chen is a Retirement Finance Analyst at RetireMetric.com, specializing in retirement savings benchmarks and catch-up strategies for late starters.

Leave a Reply